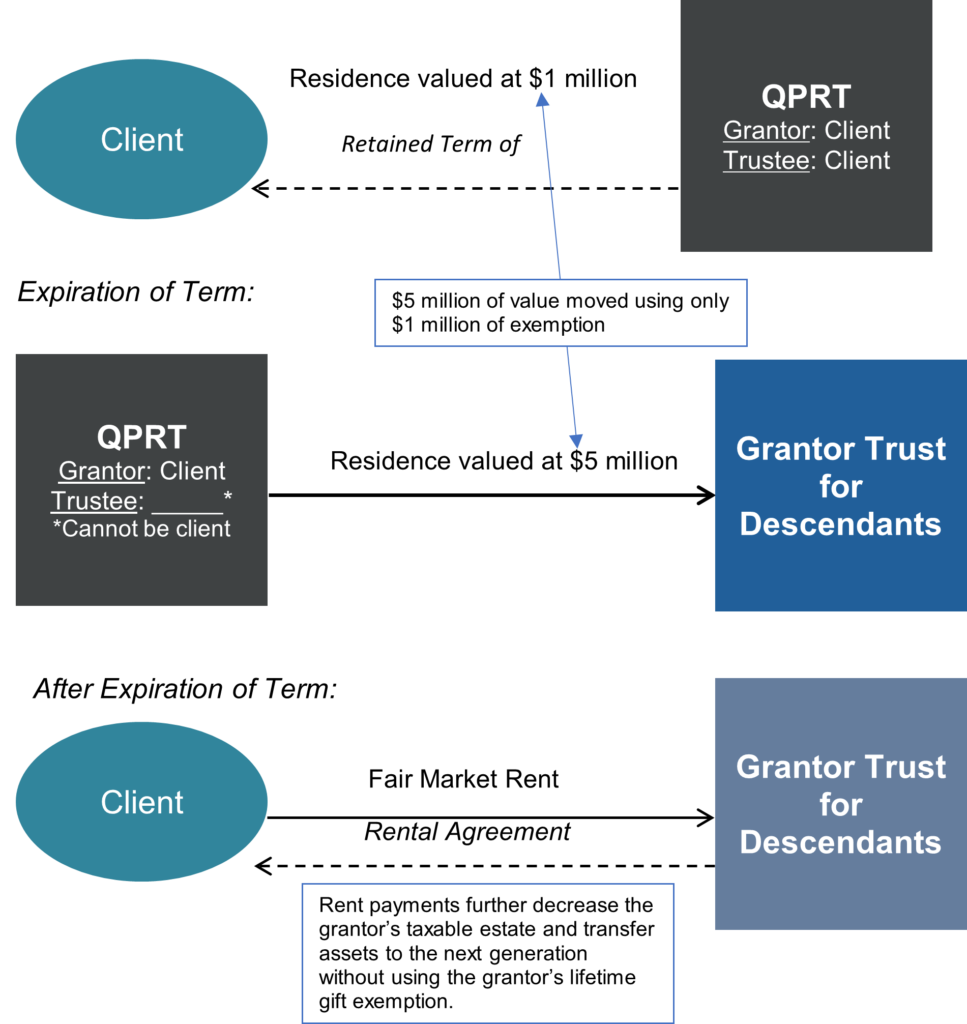

A Qualified Personal Residence Trust (QPRT) is a trust that owns a personal residence for a term of years. The person or persons creating the QPRT (grantors) will live in the residence during the term, and, after the expiration of the term, title to the personal residence passes consistent with the grantor’s estate plan (often to an irrevocable trust for the benefit of the grantor’s descendants). QPRTs offer many estate tax, income tax, and creditor protection benefits that the remainder of this whitepaper will briefly discuss.

Mechanics of a QPRT:

- A trust document is drafted that incorporates the provisions required by the statute and regulations of the Internal Revenue Code. In addition, the trust document stipulates what happens after the QPRT term expires; the grantor can make whatever provisions he or she desires regarding the residence after the term expires, so long as the title passes to the remainder beneficiaries (or continues in trust for them).

- The grantor must contribute a personal residence to the trust as its only asset (note, there are allowances for small amounts of cash if such cash is to be used for qualified purposes within a specific period of time).

- A personal residence is either (a) the grantor’s principal residence or (b) a residence that the grantor occupies for at least 14 days out of the year (such as a vacation home).

- A Form 709 (federal gift tax return) is filed, reporting the value of the gift made by the grantor to the QPRT.

- The amount of the deemed gift attributable to the QPRT is a function of the length of the QPRT term. Specifically, the longer the QPRT term, the smaller the gift will be.

- This relationship is attributable to the fact that the value of the remainder interest in the residence decreases the longer that the beneficiaries have to wait for legal ownership. The length of the QPRT term is a judgment call – the longer the QPRT term, the more risk the transferor will not survive the QPRT term.

- The contribution of the residence to the QPRT will be a gift by the grantor at the time the QPRT is created.

- The amount of the gift is equal to the fair market value (FMV) of the residence less the value of the grantor’s retained interest in the QPRT.

- The retained interest in the QPRT is a combination of (a) the present value of the grantor’s right to live in the residence during the term and (b) the present value of the reversion interest based on the grantor’s right to control the disposition of the residence if the grantor does not survive to the end of the term.

- The value of the gift will almost always be significantly lower than the value of the residence. The longer the term, the greater the retained value, but this will also increase the risk that the grantor may not survive to the end of the term.

- The trust will own the residence, and the grantor will be allowed to live in the residence rent-free during the term of the trust.

- Other individuals (i.e., the transferor’s spouse) may live in the residence rent-free as long as this condition is met. Even if the transferor were to make some other living arrangement on an indefinite basis, the QPRT status would continue as long as the residence continues to be held for the transferor’s use.

- However, the residence cannot be rented if the transferor is not living there.

- The trust must own the residence. If the residence is sold, the trustee must do one of the following:

- Purchase a new residence within two years, which will continue to be held in the QPRT.

- Terminate the QPRT and distribute all the proceeds to the grantor (this would eliminate the estate tax benefits of the trust).

- Convert the trust to a Grantor Annuity Trust, which pays the grantor an annual annuity until the term expires.

- After the expiration of the term, the residence passes pursuant to the terms of the trust agreement. If the grantor determines that it would still be beneficial to use the residence after the end of the term, there are a few options to consider are:

- The grantor could rent the house (paying fair market value rent) from the trust remainder beneficiaries, oftentimes a grantor trust for the grantor’s descendants.

- The grantor could purchase the residence from the trust remainder beneficiaries. One approach would be to use a long-term installment note. At the grantor’s death, the unpaid balance of the note (and any accrued interest) will be a claim against the grantor’s estate, which will reduce the value of the estate for estate tax purposes.

Benefits of QPRTs:

- Creditor Protection: a QPRT can offer significant protection from creditors. Specifically, upon the transfer of the residence to the QPRT you no longer have the legal ownership of the residence, generally meaning any future creditors cannot seize the residence to satisfy a claim. Although you would have retained the right to live in the residence for the QPRT term, that right is typically unappealing for a creditor to monetize.

- Income Tax Efficiencies: A QPRT and the trust to receive the property after the expiration of the QPRT’s term may be structured as “grantor trusts”; that is a disregarded entity for federal income tax purposes. This dynamic provides many advantages. First, after the QPRT term, the transferor will be required to pay fair market value rent to the QPRT. However, because the QPRT is a grantor trust as to the transferor, the rent payments will have no adverse income tax effects as the transferor will effectively be paying the rent to herself. In fact, the payment of rent by the transferor has the favorable estate tax consequence of reducing the value of the transferor’s estate without having made taxable gifts

- Gift Tax Efficiencies: As the grantor is paying fair market rents after the expiration of the QPRT’s term, such rental payments are reducing the grantor’s taxable estate; however, such rental payments are not gifts for estate and gift taxation. Accordingly, the grantor is able to reduce the grantor’s estate without having to use the grantor’s lifetime gift and estate tax exemption.

Risks of QPRTs:

- Dying Before Term Expires: The grantor must survive the QPRT’s term; should the grantor pass away prior to the expiration of the QPRT’s term, then the value of the residence will be included in the grantor’s taxable estate.

- Generation Skipping Transfer Tax Inefficient: Generally, Generation Skipping Transfer Tax (GSTT) exemption can only be allocated to QPRT assets after the expiration of the QPRT term (i.e., after the expiration of the estate tax inclusion period). Accordingly, if the value at the time of transfer is $1 million but at the expiration of the term the value is $5 million, a grantor would need to use $5 million of GSTT exemption instead of $1 million should the grantor desire to make the assets GSTT exempt.

- Loss of a Stepped-Up Basis: As the personal residence is no longer included in the grantor’s taxable estate at the time of the grantor’s death (assuming the QPRT term has expired), the personal residence is not eligible for a stepped-up basis for federal income tax purposes.

Example of QPRT Structure:

During the QPRT Term:

This blog was drafted by Samuel M. DiPietro, an attorney in the Spencer Fane Phoenix, Arizona, office. For more information, visit www.spencerfane.com

Click here to subscribe to Spencer Fane communications to ensure you receive timely updates like this directly in your inbox.